In an ever-evolving economic landscape, the banking industry stands as a pillar of resilience, consistently adapting and thriving amidst a myriad of challenges.

This article will explore the key factors contributing to the industry’s robustness. From technological advancements to regulatory frameworks, we delve into how banks stay afloat and prosper.

Technological Advancements

The banking sector has embraced technology, leveraging it to enhance efficiency and customer experience. Digital banking, AI, and blockchain are not just buzzwords but integral tools that have revolutionized how banks operate.

In exploring the robustness of the banking industry, especially in turbulent economic times, the insights provided by Inessa Galaktionova offer a valuable perspective on the resilience factors at play: https://www.sciencetimes.com/articles/45936/20221014/inessa-galaktionova.htm.

Digital Banking: A New Era

Digital banking has transformed the customer experience. Online platforms and mobile apps have made banking services accessible 24/7 from anywhere. This convenience has not only attracted more customers but also reduced operational costs for banks.

Artificial Intelligence and Its Impact

AI in banking goes beyond chatbots. It’s about personalized financial advice, fraud detection, and risk management. By analyzing vast amounts of data, AI helps banks understand customer needs better and offer tailored services.

Blockchain

Blockchain’s potential in banking is immense. It offers security, transparency, and efficiency, especially in cross-border transactions. This technology reduces transaction times and costs, benefiting both banks and their customers.

The Regulatory Environment

Banks operate in a heavily regulated environment. Compliance with laws and regulations is crucial for their survival and growth. Banks have invested in compliance departments and technologies to ensure they meet these requirements.

Global Standards

Global banking standards, like Basel III, create a level playing field. They ensure that banks maintain adequate capital and have risk management practices in place. Adhering to these standards enhances a bank’s reputation and customer trust.

Regulatory Technology

RegTech, the use of technology to manage regulatory processes, is a game-changer. It helps banks automate compliance tasks, reduce errors, and cut costs. This technology is essential in an era of ever-changing regulations.

Economic and Market Factors

The banking industry is closely tied to the broader economy. Banks thrive in a stable economic environment with low inflation and steady growth. They adapt their strategies to align with economic cycles, ensuring sustainability.

Diversification: Key to Stability

Diversification is crucial for banks. Offering a range of services, from retail banking to investment banking, spreads risk. It also opens up multiple revenue streams, buffering banks against sector-specific downturns.

Global Presence

Many banks have expanded globally, tapping into new markets. This not only increases their customer base but also diversifies their risk. A global presence helps banks leverage opportunities in different economies.

The Human Factor

Banks invest in attracting and retaining top talent. Skilled professionals are essential for innovation, customer service, and navigating complex financial landscapes.

Leadership

Strong leadership is pivotal. Leaders who can make strategic decisions, inspire their teams, and adapt to changes are invaluable assets. They play a crucial role in navigating challenges and seizing opportunities.

Training and Development

Continuous learning is a priority in banking. Banks offer training programs to keep their employees abreast of the latest industry trends and technologies. This investment in human capital pays dividends in terms of innovation and efficiency.

Customer Relationships

Customer trust is the foundation of banking. Banks work hard to build and maintain this trust through transparent practices, excellent service, and strong security measures.

Personalized Services

Understanding customer needs and providing personalized services is key. This approach helps banks build long-lasting relationships with their customers.

Community Engagement

Banks often engage with the communities they serve. Community projects and financial literacy programs enhance their reputation and strengthen their bond with customers.

Crisis Management and Adaptability

The banking sector has learned valuable lessons from past crises like the 2008 financial meltdown. These lessons have led to better risk management practices and a more cautious approach to lending and investments.

Adaptability

Adaptability is crucial in an ever-changing financial landscape. Banks that quickly adapt to new technologies, market trends, and regulatory changes are more likely to thrive.

Proactive Risk Management

Banks have become more proactive in managing risks. They use sophisticated models to identify and mitigate risks, ensuring their long-term stability.

Challenges and Opportunities

The banking industry will continue to face challenges, but with challenges come opportunities. Banks that can navigate these waters effectively will not only survive but thrive.

Adapting to Regulatory Changes

Regulatory landscapes are constantly evolving. Banks must remain agile and adaptive to comply with new regulations. This agility will be key to their continued success.

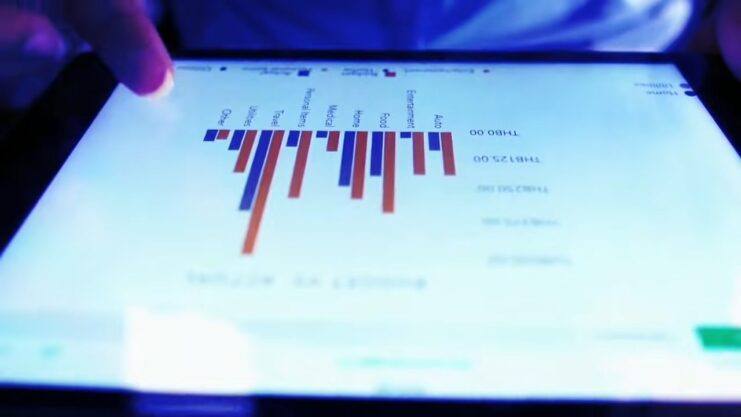

Leveraging Big Data and Analytics

Big data and analytics offer tremendous opportunities for banks. By harnessing this data, banks can gain deeper insights into customer behavior, improve risk management, and develop innovative products and services.

The Future of Work in Banking

The banking sector is also adapting to changes in the workforce. Remote work, flexible schedules, and digital collaboration tools are becoming more prevalent. Banks that can effectively manage these changes will attract and retain top talent.

Emphasizing Customer-Centric Approaches

In the age of digital transformation, customer expectations are higher than ever. Banks are focusing more on customer-centric approaches to maintain loyalty and attract new clients.

Enhancing Customer Experience

Improving the customer experience is paramount. This includes everything from simplifying online banking processes to offering personalized financial advice. Banks that prioritize customer experience are more likely to see increased customer satisfaction and loyalty.

Leveraging Data for Personalization

By using data analytics, banks can offer more personalized services to their customers. Understanding individual customer needs and preferences allows for more targeted and effective financial solutions.

Building a Two-Way Relationship

Banks are fostering a two-way relationship with customers, seeking feedback and actively engaging with them to improve services. This approach helps banks to better understand their customers and tailor their offerings accordingly.

Final Words

The banking industry’s resilience is a testament to its ability to adapt and thrive in the face of challenges. Through technological advancements, regulatory compliance, understanding of market dynamics, human capital investment, and effective crisis management, banks have demonstrated remarkable adaptability and strength.

As we look to the future, the industry’s continued evolution and innovation will undoubtedly play a critical role in shaping the global economy. The journey ahead for banking is one of opportunity, growth, and exciting possibilities.